FINTECH TECH4FIN MILEStone 1 MUSA SPOKE 4 WP BOCCONI

FINTECH FOR SUSTAINABLE ECONOMIC GROWTH IN ITALY AND IN EUROPE

The goal of the Fintech and Tech4Fin Work Package (WP hereafter), part of the MUSA project, is to explore new avenues to exploit the economic growth potential that may derive from a better the integration between providers of financial services and the most recent innovations in the area of information technologies.

The specific action plan aims at exploring the IT and regulatory infrastructures that can be deployed to promote efficient decentralized private organizations, like industrial clusters and value chains, out of the fragmented texture of European economy populated by Small and Medium Enterprises (SME hereafter) with a specific focus on entities that are framed within the Italian regulatory framework.

The project under development targets explicitly growth opportunities that comply with the United Nations sustainability criteria and are compatible with corporate sustainability directives that are currently under discussion for approval from the European Union parliament.

This wiki infrastructure is aimed at exploring the existing fintech infrastructures and the potential growth opportunities in relation to a specific class of fintech business activities: those that are related to decentralized organizations.

Introduction

Modern economies are characterized by a high level of interdependence between producers, consumers and intermediaries of goods and services. Information acquisition and coordination among stakeholders are thus key conditions for the emergence of a successful path toward sustainable and equitable economic growth. It may be harmed by frictions that generate transaction costs and reduce the space for cooperation, while it is certainly favored by the emergence of an institutional framework where competing interests can be regulated.

The development of the European Union regulation is aimed at introducing a common level playing field where economies of scale may emerge and bring more efficiency. Common rules must necessarily balance diverging national interests with the cooperation efforts that are necessary to make the EU competitive at the international level. For example, the Capital Market Union (CMU hereafter) initiative is trying to complete the integration of internal financial markets, while the Corporate Sustainability Due Diligence Directive (CSDDD hereafter) under discussion is setting common procedures to address adverse impacts of their actions and those of their value chain partners on human rights and the environment.

Despite these efforts, it is fair to say that fragmentation is still a common trait of the continental economy and the industrial body is often not well integrated. Lagging homogeneous financial economic conditions fostering competition, Europe is an economic environment where decentralization is the rule rather than the exception both in the public and in the private sector.

For example, at public level the European System of Central Banks, the central banking system backing the Euro is formed by the National Central banks and by the European Central Bank and is decentralized at physical and organizational levels. Similarly, the Euronext stock exchange group, currently manages seven local sites and is publicized as a pan-European market with deep roots in local countries. As a consequence, network effects are strong and often key to understand the main profitability and risk drivers affecting the overall economy.

The specific action plan of this MUSA project WP aims at exploring the information technology and regulatory infrastructures that can be deployed to create more efficient decentralized private organizations, like for examples industrial clusters and value chains, out of the fragmented texture of Small and Medium Enterprises (SME hereafter) that populate the European economy.

The explicit goal supporting the investment in these infrastructures is to make more sustainable and resilient these clusters while preserving the autonomous governance and financial independence of individual enterprises.

In the following, we provide a systematic examination of the current state of the art on the existing state of digital and regulatory infrastructures that may be relevant to promote a more efficient development of decentralized industrial organization.

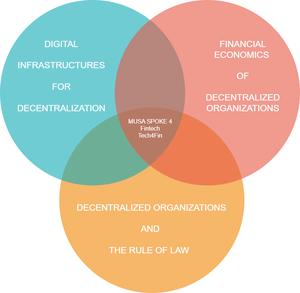

Our analysis addresses the issue of decentralization from three different perspectives:

- Exploring at empirical and theoretical level the cost and benefits of decentralization from the point of view of the industrial organization and financial economic.

- Reviewing the existing rule of law focused on decentralized organizations.

- Exploring the benefits that may spillover from the development of distributed ledger and blockchain technologies.

In particular, our discussion will target the potential benefits that may arise from the development of digital platforms over decentralized data architectures. This seems to be a particularly promising avenue to foster economic growth in continental Europe where the centralization of the economic activities through the ‘platformization’ has been mainly driven by external multinational actors while the creation of domestic digital infrastructures is lagging.

Differently from any decentralized project developed over the crypto-space, the focus of this project is on the use of Distributed Ledger Technologies (DLT hereafter) to foster business and financial integration of an underlying private organization where decentralization and fragmentation are the status quo, a characteristic of a consolidated productive organization within an established legal framework.

In light of this fact, it will be shown that the implementation and the adoption of distributed digital infrastructures in this new framework pose different challenges and at the same time offer a new perspective also on Decentralized Autonomous Organizations (DAO hereafter) and on decentralized finance, as conventionally defined.

This wiki-documentation support is intended to establish a framework where the state of the art is reviewed and a common language useful to establish a precise relationship between the different notions of decentralization\delegation as they are commonly defined in different contexts ranging from industrial organization, financial economics, information sciences and last but not least by the rule of law, with specific reference to Italian and EU regulation.

The Research Question(s)

In particular the discussion will be focused on a number of following critical issues that have to be answered to capture the benefits of decentralization while minimizing delegation costs:

- Which are the relevant economic factors that are relevant to and are affected by the degree of centralization of a private economic organization?

- Consider the distributed architectures of the available digital infrastructure technologies, which are the key features that reverberate on the degree of coordination and the level of information of the members of the organization?

- The regulation already set in place enforces checks and balances that shape the incentives inside and outside the existing decentralized organizations, in a broad sense. Is it possible classify and qualify those regulatory approaches that have been more effective in regulating decentralized organizations?

- Which are, if any, the specific functions that the rule of law should keep in order to preserve ‘trust’ even in the presence of cryptographically enforced ‘contracts’ to optimally regulate the decentralized autonomous organizations?

- There exist different DLT based solutions that differ in relation to the physical and regulatory infrastructure that are required for a decentralized digital platform to operate. Is it possible to establish a cost-benefit analysis in relation to the value added that the platform offers to specific decentralized organizations?

- Among the major pitfalls of existing decentralization solutions, the financial fragility that derives from ownership fragmentation is probably the most relevant. Is it possible to establish a common discipline to promote the integration between traditional, centralized financial services and the growing body of products and procedures known under the name of decentralized finance?

The State of the Art

The first part of the project has reviewed the State of the Art, the existing evidence about decentralized organizations as they are classified and understood in the three relevant scientific fields where this problem has been discussed along the same line of development illustrated above.