CBDC

The Evolution of Central Bank Digital Currency

Written by Alessia Arrigoni.

Introduction

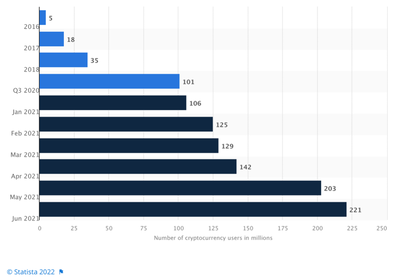

Developments in technology, changes in taste, and economic growth have affected monetary transformations. Digitalization has in fact paved the way for new financial assets and new forms of money, such as Central Bank Digital Currency (CBDC). Matters revolving around the present and future of money not only are an age-old issue but are also a current topic since the digital evolution has already affected virtually every aspect of daily life, and it is also transforming how people perceive and use money. Moreover, it is worth noting that such changes directly affect the role of central banks. In today’s highly digitalized environment, money has taken on different forms, from cryptocurrencies to stable coins and e-money, which have quickly gained popularity in pockets around the world – between 2028 and 2020, global users of cryptocurrencies increased by nearly 190%[1], and this figure is expected to further increase.

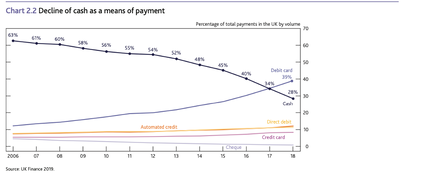

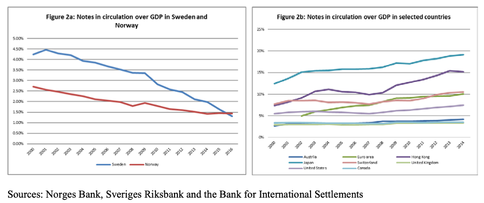

Furthermore, it has become less and less surprising to hear news broadcaster talk about the rise and fall of Bitcoin or Ethereum, further proving that the public is growing more acquainted to the monetary alternatives to cash[2]. This departure from cash, and overall change in money and payments was also accelerated due to the recent Covid-19 pandemic. Banknotes have been the primary mean of payments for over 300 years, but today people are making fewer payments in cash – it is expected that only 9% of payments[3] will be made in cash by 2028 – and are instead switching to cards or the new forms of money and payments. Nevertheless, cash maintains a crucial role. During a Keynote speech at the Deutsche Bundesbank’s 5th International Cash Conference, Fabio Panetta explained that although “Even before the pandemic, the future of cash was being discussed as the use of digital payments accelerated […] faster digitalization does not spell the end for cash any time soon”[4].

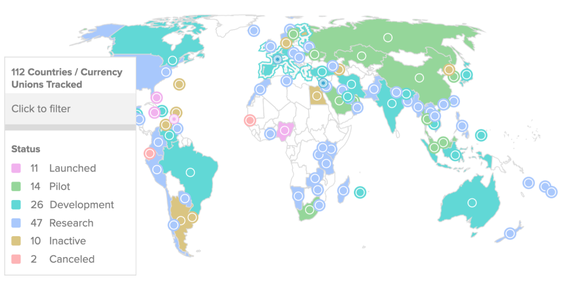

In light of this, many central banks are beginning to question how the future of money will look like and as of today 105 countries, representing over 95% of global GDP, are looking into pursuing CBDCs. Data shows that 50 countries are in an advanced phase of research, whilst over 10 countries – such as China with its e-CNY or Nigeria with project e-Naira – have already launched a digital currency[5].

Understanding the implications of the introduction of a Central Bank Digital Currency is therefore crucial and is the topic of research of this paper. First, it is necessary to understand what a CBDC is, and how its design structure defines not only its use cases, but also its challenges. Secondly, this paper will explain the consequences of the implementation, highlighting how it could impact the economy and monetary policy transmission. Finally, the topic of currency competition is discussed in light of the changes and challenges that digitalization has brought.

Chapter 1. Design Features of Central Bank Digital Currency

A CBDC is defined as “a digital form of central bank money that is different from balances in traditional reserve or settlement accounts”[6], it is therefore “a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank”[6].

To better understand what a CBDC is and where it fits within the existing monetary landscape, Beach and Garratt built the “money flower”. The “money flower” is a Venn-diagram that recognizes four main properties of money: widely accessible, digital, central bank issued, and token based. Due to its characteristics, CBDC is found in the middle of the diagram.

In light of this, CBDC can take different design forms, mainly concerning ledger design, form of access, taxonomy and distribution. These design choices are crucial as they influence and determine the use cases and implications of introducing a CBDC.

1.1 Ledger Design

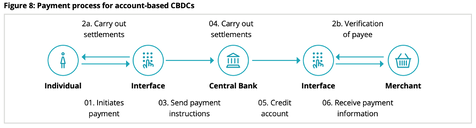

Within the CBDC infrastructure, a payment is the transfer of a central bank liability, and it is recorded on a digital ledger, which can be a blockchain or not. The ledger is a database shared between nodes in a network where the participants of each node can access the information shared through the network. A peculiar feature of a digital ledger is the fact that changes or additions are copied to all nodes virtually instantaneously, which implies a lot of responsibilities for central banks to ensure trust and efficacy of their digital currency. Hence, the characteristics of the ledger are an important feature of a CBDC and are being researched by many shareholders. Here the discussion lays on the choice between a centralized, semi-decentralized or decentralized structure. With a centralized approach, an intermediary is required to manage and transfer the liabilities, meaning that the central bank itself is running the system. This is a very straightforward design and may be desired from a management point of view as it allows for easier control on anti-fraud and security features. Nevertheless, it poses challenges of robustness and public trust. In fact, all nodes are under the direct control of one institution, which can potentially change the rules and cause damages. Semi-centralized ledgers instead reduce the degree of centralization: independent parties approved or chosen by the central bank can operate the CBDC. On the surface, this appears to be a solution similar to the centralized approach – central banks appoint other entities to run the system – but a closer look reveals that the approach is different, because the central bank forgoes its total control. By increasing the number of entities – up to dozens or even hundreds – involved in the system, changing the rules, or performing censorship becomes more complex. With this mechanism, the central bank can facilitate agreements among the parties to implement changes. Finally, using blockchain infrastructure similar to those of cryptocurrencies provides for the most decentralized approach. A decentralized ledger, also known as permissionless, allows anyone to join and operate the system, without needing permission from the central bank. In a permissionless system, changes require a wide agreement between the independent parties, which makes controversial changes unlikely, but also reduces the degree of control exercised by the central bank. The choice for a decentralized ledger can be complicated for a central bank, as it takes away control even in cases when it is necessary, like for mistaken transactions. Moreover, implementation is not clear. To ensure the security of the system, central banks could introduce incentives for system operators to follow protocol and “although it does not choose the miners in the open system, the central bank in this setup is still uniquely powerful, as it determines the reward rules”[7]. Incentives like Proof of Work and Proof of Stake are already used in Ethereum and Bitcoin for securing decentralized blockchains. Given the extreme lack of central control, a fully open and permissionless ledger design is not the natural choice for a CBDC. The European Central Bank, for instance, is considering the implication of “some decentralization of responsibility to users and/or supervised intermediaries”[8] in the back-end design of a digital euro. The ECB recognizes decentralization to be a viable solution only if it were possible to ensure that central bank requirements are followed with every transaction and that the infrastructure developed offers adequate security and processing capacity. This means that, regardless of the approach choice, the ECB believes that control of the infrastructure should ultimately be remain with the central bank.

1.2 Form of access

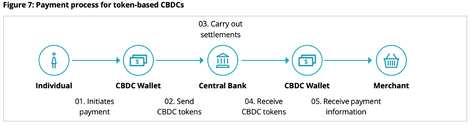

When it comes to the form of access, two main options have been identified: account-based or value-based[9]. All types of money are in fact based on one of these technologies. Cash and some digital currencies, such as Bitcoin, are examples of token-based money, while balances in reserve accounts and commercial bank money are account-based. The main difference between value-based and account-based money is the form of verification of the transaction. Value-based, or token-based, money relies “on the ability of the payee to verify the validity of the payment object”[10], whereas account-based money relies “on the ability to verify the identity of the account holder”[10]. The distribution of a token-based CBDC would hence involve transferring an object of value from one wallet to another[11]. This system provides a lot of privacy but would make it harder to trace money laundering and fraudulent transactions. Moreover, to avoid losing access to the funds, it is essential for the customer to remember the access keys. Although a seemingly easy thing to do, this has already proven to be an issue. For instance, Stefan Thomas has made news because he no longer can access his digital wallet containing Bitcoin that would make him a millionaire. Moreover, A New York Times article explains that “of the existing 18.5 million Bitcoin, around 20 percent […] appear to be in lost or otherwise stranded wallets”[12].

Contrarily, with an account-based CBDC, distribution entails transferring money from one account to another, requiring central banks to verify the existence of digital accounts for each user.

As highlighted by their individual features, one of the issues identified with value-based money is counterfeiting: a forged cash note could be used in a transaction, or similarly for digital currencies, one could question the genuineness of the coin or whether it has already been spent. Instead, the concern for account-based money is identity theft, highlighting the importance of the identification process to link payers and payees. Traditionally, regulators and central banks have preferred a token-based approach for cross-border transactions, despite it providing high levels of anonymity for users. Moreover, central banks have overall limited access to account-based forms of central bank money, although this approach could allow regulators to oversee transactions more closely.

1.3 Retail and Wholesale CBDC

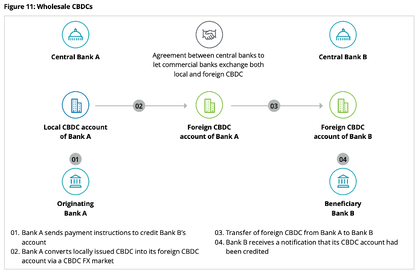

Both retail and wholesale CBDC are believed to benefit the global economy, so much that some central banks have already introduced these technologies. Wholesale CBDC are to be used by regulated financial institutions, for large value and priority payments such as settlement of interbank transfers or related transactions. Essentially, a wholesale CBDC is similar to a reserve and settlement balance account with a central bank, meaning that it is issued, stored and maintained by the central bank or a designated entity. The use of wholesale CBDC could improve efficiency and risk management, making central bank money more programmable and encourage automation.

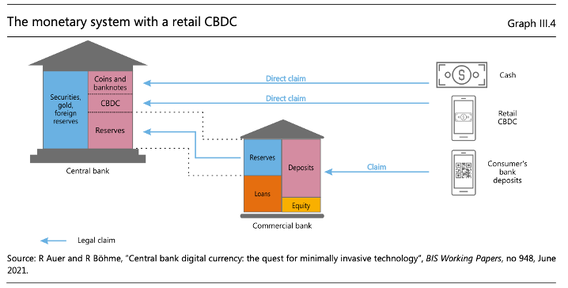

Instead, retail banking focuses on large volumes of low-value payments, like cheques and card payments, and hence a retail CBDC would become an alternative to cash and be used as a mean of payment[13]. When compared to cash, it is found that a retail CBDC has similar features: 24/7 availability and anonymity – although when it comes to anonymity, a CBDC is not entirely anonymous. Moreover, a retail CBDC would be accessible to everyone, implying that anyone could open bank accounts directly at a central bank and have access to central bank money – just like cash is available to the general public. This introduces significant changes to the current system, which is built on two tiers: the customer-facing banking system and the central banks system.

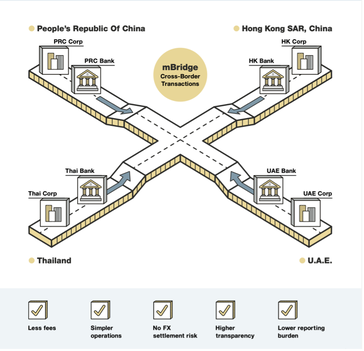

Different jurisdictions have already started experimenting with the different CBDC designs and the APAC region has certainly been at the forefront. For instance, Thailand is exploring a retail based CBDC to be conducted in two phases. The first phase, which will be piloted in 2022, entails assessing the possible use cases of digital money in comparison to cash transactions, instead in the second phase would include innovation and new use cases. The Bank of Thailand has stated that “the CBDC could be initially designed as non-interest bearing akin to cash, with specified limits for holding, transacting and conversion”[14]. The Honk Kong Monetary authority, instead, has been working on a CBDC project to handle “large-value payments and delivery-versus-payment settlement”[15]. Through the partnership with the Digital Currency Institute of the People’s Bank of China (PBC DCI), and the Central Bank of the United Arab Emirates (CBUAE), and with the support of the Bank for International Settlements Innovation Hub (BISIH), this project has turned into the Multiple CBDC Bridge, a trial platform to “increase the speed of cross-border payments from multiple days to near real-time, while also reducing cost”[16].

1.4 Interest bearing and interest free CBDC

Similar to the other liabilities of central banks, it would be possible to pay interest on CBDCs[17]. Such interest rate can follow existing policy rates or be set to a different value to either encourage or discourage demand. For instance, paying positive interest would make a CBDC more attractive as an instrument intended to also be a store of value. This design choice may be advisable when network effects are strong. Instead, a non-interest bearing CBDC would be a suitable substitute for cash and commercial bank deposits, hence having welfare costs to the extent that it might crowd out the demand for those. For a cash-like CBDC, the network effects might even make cash disappear, whilst a deposit-like design increases deposit and loan rates, leading to a reduction in banks’ lending to firms.

Chapter 2. The implications of CBDCs

Having defined the different and many design options for CBDCs, it is now important to understand the impact of their introduction, as it should not harm the economy or cause financial disruption that could impair monetary policy transmission.

The issuance of CBDC can be seen “as a strategy to provide an alternative virtual currency”[18], as it would be a stable virtual currency and become a unit of account within cryptocurrency markets. Price stability has in fact been a concern in cryptocurrency markets, and the attempts to create stablecoins have so far been restricted to using collateralization techniques, thus creating cryptocurrencies collateralized by fiat money or other cryptocurrencies. Nevertheless, these techniques do not provide long-term safety and stability, which instead can be provided by Central Banks, leveraging their existing credibility. This leaves a gap in the market that Central Banks can fill. Moreover, the introduction of CBDC provides potential welfare-enhancing effects, that go from philosophical and sociological arguments to financial inclusion.

2.1 Financial stability

As the number of countries interested in CBDC is increasing, it becomes crucial for central banks to study the implications of the introduction of CBDCs especially in terms of financial stability. When it comes to financial stability, the discussion focuses on financial intermediation, which is the process of channeling funds between parties with a surplus to those who need them – essentially a bank’s job. The introduction of CBDCs is believed to “crowd out bank deposits and payment activities”[4] and disrupt the modern payment system of credit lines and deposits. Piazzesi, M. and Schneider, M.[19] in fact argue that an alternative payment system would resemble a negative technology shock affecting consumption, investment, and the allocation of labor, resulting in overall lower welfare. Nevertheless, there are two main arguments against this view. Firstly, the extent of the risks posed by the issuance of CBDC depends on the choices made by central banks. This means that central banks can get the help of financial intermediaries and leverage their experience for tasks such as onboarding customers and anti-money laundering checks, thus preserving their role in front end services. Moreover, the different design choices, like those concerning anonymity and bundling opportunities, affect demand for CBDC by its end users, and consequently determine the associated risks. To mitigate these risks, safeguards such as tiered remuneration and holding limits can be implemented. Central Banks can also intervene to ease liquidity conditions in the case of excessive strains to the composition of bank funding. Essentially, the impact of the introduction of CBDC would be manageable in normal times. Secondly, CBDCs could also have positive effects on the financial system. For instance, CBDCs can “ensure that sovereign money continues to play its role in underpinning confidence in money and payments”[4] and become a reference value for all other private currencies. This is especially important as cash demand decreases and people’s wallets are becoming more and more diversified. Essentially, the introduction of CBDC protects the value of money and monetary sovereignty. It was also found that CBDC would facilitate access to payments and reduce transaction costs, hence improving the allocation of capital. This, in turn, would unlock new business opportunities and foster competition in bank’s funding markets. Moreover, it would act as a further incentive to support digitalization in the banking sector whilst levelling the field to those more exposed to competition by new entrants such as tech firms.

These considerations have led researchers into believing in the positive implications of introducing CBDCs, or rather that the risks are manageable and foreseeable during normal times. However, these risks increase in times of crisis when confidence in banks decreases. Nevertheless, research on a digital euro has suggested that “adequately designing and calibrating CBDC safeguards could help to counteract the adverse effects of CBDCs on bank runs”[4]. Fabio Panetta, Member of the Executive board of the ECB, strongly believes that the risks associated with CBDCs can be mitigated with the right safeguards and even argues that it could be a tool to offset the risk of bank runs.

2.2 Monetary policy implications

If there is overall consensus on the implications of CBDCs on financial stability, when it comes to monetary policy, the matter is not as straightforward, because it could both strengthen and weaken monetary policy transmission. The introduction of an unconstrained and unremunerated CBDC is also relevant in terms of the zero lower bound constraint (ZLB), according to which the nominal interest rate imposed by central banks cannot be lower than zero. Conventional monetary policy relies on the central bank to set a “base rate” to be paid on reserves from commercial banks. This “base rate”, in turn, impacts the “overnight rates” for loans in the interbank market. When the economy is threatening to go in a recession, the conventional response by central banks is to lower the “base rate” which leads to lower interest rates paid to banks – i.e. the cost of borrowing is reduced. This policy fails as rates approach the ZLB, as banks would then be charged for their reserves at central banks. Under these circumstances, a rather weak argument for the use of CBDC argues that in concomitance with the abolition of cash and other substitutes, the efficiency of monetary policy instruments would be increased, but this reasoning also implies that “if there would be no need for going below ZLB, there would also be no need for introducing CBDC”[18] . Moreover, if the ECB were to issue the digital euro, it would not be used as a monetary policy instruments and physical banknotes would still be issued. Essentially, the design of a CBDC needs to solve the “CBDC trilemma”[20]: a central bank cannot achieve a socially efficient solution, financial stability (absence of runs), and price stability altogether and that when one objective is prioritized, at least one has to be sacrificed.

This evidence highlights how design choices are crucial to determine the effects of the introduction of CBDCs. For instance, to limit negative effects on monetary policy and to prevent runs, ceilings on individual holding could be implemented. Moreover, introducing a CBDC without any constraints would likely be damaging and impact the funding structure of banks. Nevertheless, such constraints need to be balanced so that the final effect does not reduce the scale and scope of CBDC use.

Moreover, the introduction of CBDCs could help the operation of unconventional monetary policies, such as Quantitative Easing, which have been ever-increasing since the global financial crisis. In particular, the idea of “helicopter money” is gaining traction in relation with CBDCs. “Helicopter money” requires a central bank to “create new money and distribute an equal amount, as a non-repayable grant, to every citizen, in order to increase their ability to spend (or repay debt)”[21]. Seeing as the implementation of this unconventional policy involves a distribution channel to guarantee that the new money goes into the right accounts, a digital cash system would be the perfect solution.

To sum up, as explained by Fabio Panetta during his most recent speech, digital public money represents “the natural evolution to guarantee that the two-layer monetary system remains viable”[22].

2.3 Recapturing a portion of seigniorage

The ECB defines seigniorage as the interest earned by central banks on the money it lends[23]. Historically, seigniorage was the difference between the face value of a coin and the market value of its metal, but nowadays its computation is more complex. CBDCs come into play when considering the change in demand to hold physical and digital money. In fact, seigniorage is currently limited by the public’s demand for cash, seeing as how it can be inconvenient to hold and is disconnected from the electronic payment railways. Essentially, if the value of bank notes falls, seigniorage would decline. Hence, if a central bank were to offer a way to hold digital cash that is as convenient as bank deposits and connected to the electronic payment system, the total demand for holding central bank money in physical and digital forms may turn out to be greater than the demand to only hold physical cash. The amount of seigniorage collected would not be affected if people just switched from physical cash to digital cash, but if those with bank deposits converted their holdings into digital cash, seigniorage revenue would increase. Nevertheless, despite the decline in the use of cash, the value of notes outstanding has not been affected – distribution of notes has shifted towards higher denominations, which generate more seigniorage – meaning that seigniorage is not effectively at risk in most countries[24].

All things considered, the introduction of CBDCs would provide an alternative source of revenue for central banks, but it not considered a compelling enough motivation.

2.4 Financial inclusion

It is also suggested that CBDC could improve financial inclusion, although it is not a major issue in most advanced economies. On the contrary, it is an important concern for emerging economies, where a CBDC could theoretically allow access to electronic payment to the entire population. Since matters of financial inclusion are not very straightforward, CBDCs could have greater impact on financial inclusion and its barriers as part of a suite of tools and with the support of complementary policies. In fact, barriers to inclusion vary greatly among countries, but have been classified in geographic barriers, institutional factors, economic and market structure barriers, characteristics of vulnerability, limited financial literacy and limited trust in financial institutions. Moreover, it could be an opportunity for central banks and governments to promote universal access to financial services, by establishing a base level of service quality and consequently fostering competition and innovation in the private sectors. In essence, the case for CBDCs improving financial inclusion has some merit but requires deeper research as it is to be discussed from many perspectives.

2.5 Currency competition

The introduction of CBDC means that along with bank deposits, there would be another form of digital money, thus creating competition between these two currencies which are also so similar to be “perfect substitutes”. Concerning the customers’ choice between these two forms of digital money, the key difference is that bank deposits have credit risk above the level of government guarantee – for instance, in Europe depositor’ savings are guaranteed up to €100,000, whilst in the UK up to £75,000 –, meaning that users with larger amounts of money not covered by the guarantee are more compelled to choose digital cash as it would be risk free. Moreover, digital cash would be preferred also if customers fear that in the event of a crisis, governments may not fulfill their obligation to honor the deposit guarantees and “bail in” depositors.

Chapter 3. Currency Competition

As previously mentioned, the introduction of CBDCs has an impact also on currency competition. With digitalization profoundly changing money and payment systems and making instantaneous peer-to-peer transfers easier than ever, Brunnermeier explained that “the advent of these new monies could reshape the nature of currency competition, the architecture of the international monetary system, and the role of government-issued public money”[25].

The topic of currency competition has been of interest to economists at least since Hayek’s “The Denationalization of Money” in 1976, where he suggested that competition among privately issued currencies would be the way forward.

In today’s environment, it is important to distinguish between “full” and “reduced” competition among monetary instruments. But it is important to first acknowledge the three defining properties of money: unit of account, store of value and medium of exchange. Each one of these functions arose to solve a different economic friction. For instance, Hayek believed that currencies would compete primarily as a store of value, and only those currencies with credible issuers would succeed maintaining their value, whilst others would be driven out of the market. With full currency competition, the currency’s role as unit of account is one of the aspects of competition, instead, with reduced competition, “monetary instruments denominated in the same unit of account compete in their role as medium of exchange”[25]. This latter form of competition, for instance, is prevalent today.

3.1 The unbundling and re-bundling phenomenon

One of the most striking characteristics of digital currency competition is the unbundling of the roles of money, which is brought about by a reduction in switching costs and convertibility. Convertibility in particular leads to the unbundling of the exchange and store of value role of money. In fact, Gresham’s law can also be applied to digital currencies: considering two distinct currencies issued by two different tech companies having tokens that are convertible one-to-one, the “stronger” currency will be held as a store of value, whereas the other will be used for exchanges. When it comes to switching costs, instead, it is important to point out that digital currency competition is very different from traditional currency competition. Traditionally, transaction costs have made it difficult to switch between currencies and hence currencies could not compete effectively. Moreover, trade took place mainly within geographic area, and because of this it was especially difficult for currencies to cross regions. Instead, modern technology has made it possible to have frictionless and un-intermediated transactions using digital tokens, thus lowering switching costs and circulating freely thanks to networks that can cross borders. Essentially, within a digital framework, users can seamlessly switch between currencies and, unlike in Hayek’s vision, many different currencies can be successful whilst serving different purposes. The unbundling of the roles of money thus lowers the need for coordination on a single currency by allowing users to get different services from different assets and also increases competition. If Hayek believed that currency competition would rely primarily on the store of value role, digital currencies highlight that competition can happen on all levels and that it will be much fiercer than expected. Currencies are allowed to specialize only in certain roles, meaning that those acting as store of value will compete with one another, whilst others compete separately.

By contrast, combining digital payments instruments and the functionalities of digital platforms leads to a re-bundling effect. Economic literature defines platforms as “two sided markets where buyers and sellers exchange multiple products”[25] and are “aggregators of mutually complementary activities”[25] that create “ecosystems” where service providers, consumers and merchants interact. Digital platforms have significant implications for currency competition. In fact, currencies associated with digital platforms will be much more differentiated, especially in terms of the functionalities offered through the platform. This means that a currency’s main function will no longer only be to grant payment services, but to also allow for interactions with the other users on the platform, and consequently, digital currencies become inseparable from the features of the platform. In an environment where the functions of money can be unbundled, the success of a digital currency will be determined by characteristics such as data privacy policies, information processing algorithms and the counterparties available on the platform. Essentially, competition will focus on competition between bundles of information and networking services. This re-bundling phenomenon has implications for currency competition: users have uniform preferences for ordinary currencies, whereas when it comes to these so called re-bundled currencies, preferences may be far more heterogenous. This will therefore be an incentive for large issuers to offer differentiated products, thus creating a segmented market with different platforms catering to different customer segments.

3.2 Public and private money

With digital currencies, policymakers are facing many challenging issues and will have to come to terms with the fact that money will no longer be as simple as it once was. This means that the traditional system of intermediation may become outdated and change the rules of competition between public and private currencies. Historically, private currencies in western societies never had much success, but fiat cryptocurrencies like Bitcoin are again raising questions on unbacked and privately issued money. The failure of unbacked private currencies is often attributed to the absence of a fiscal anchor and dynamic instability seeing as how it can suddenly lose its value if its users stop believing in its success. Instead, government backed currencies do not have the same instability issue because the value of the currency is guaranteed by government’s ability to tax. Nevertheless, what has previously made private currencies unsuccessful may not be applicable today since public money is now seen as a poor substitute, and digital currencies may be less vulnerable to failure. In fact, cryptocurrencies are being used for large international transactions, or to avoid capital controls. Moreover, independent currencies also pose concerns for monetary policy, which is a public function that private entities would inefficiently – not fairly – conduct. The concern is that “large private issuers of digital currencies would similarly face the concern that if permitted to freely conduct monetary policy, it would be tailored to benefit the firm rather than the public"[25]. This makes the argument for enforcement of convertibility and interoperability regimes stronger. Interoperability would in fact allow for central banks to directly provide emergency liquidity, whereas convertibility would restrain issuers’ monetary policy.

3.2.1 CBDC & currency competition

The introduction of digital platform-based currencies within today’s framework would certainly alter the financial hierarchy and potentially diminish the role of banks, which in turn would threaten monetary independence. In light of this, a CBDC could be a natural countermeasure to the effects of digitalization and change the nature of currency of competition.

One scenario sees CBDCs within a cashless society. In a cashless society, the public holds deposits or digital currencies and does not have access to public money. Moreover, people do not have access to the monetary anchors into which these assets could be converted into. This means that “private issuers would lose the discipline of public money, and their issuance would instead be shaped by other market forces”[25] and that the notion of money would fundamentally change, with its safety depending on the trustworthiness of the issuer. By comparison, this scenario sees the monetary system as behaving similarly to the broader financial system: the trustworthiness of the issuers is continuously re-assessed to evaluate monetary instruments, resulting in a further segmentation of payment instruments based on the reliability of the issuer. Through a CBDC the public would get direct access to public money, making deposits and other digital currencies convertible into CBDC and restoring substitutability between payment instruments. This makes the introduction of CBDCs favorable because it would eliminate inefficiencies caused by information asymmetries and lead to a single unit of accounts, which is essential to preserve the central bank’s monetary authority. Essentially, when it comes to competition between public and private currencies, a CBDC would “restore some power to the monetary authority without requiring the direct regulation of new currencies”[25].

The second scenario instead sees a CBDC within a payment-based financial system, where central bank money is used only as a medium of exchange and is therefore vulnerable to technological change. Nevertheless, this does not necessarily lead to a loss of monetary authority because it is the unit of account role that confers authority to a central bank, and hence “as long as transactions are made using that unit of account, the central bank will keep its power in all circumstances”[25], even if payments are no longer made with central bank money. This logic is based on the fact that financial contracts are written in the unit of account designed by the central bank. If this was to change, the financial system could shift towards digital platforms and payments may not be connected to the banks’ provision of credit. In turn, the unit of account role would disappear, along with the ability of monetary policy to have a real impact on the provision of credit. Essentially, the power of monetary policy would be weakened. In light of this, CBDC would once again allow the transmission of monetary policy to the public and shift the nature of competition so that it does not have to compete with other forms of payment.

Conclusion

CBDC research has advanced at remarkable speed and has highlighted many positive implications of its introduction that provide a valuable conceptual framework to navigate the future of money. Nevertheless, research is never complete, and there is still a lot to learn studying the consequences of pilot projects and early CBDC launches. For instance, the failure of Dinero Electrónico[26][27], a mobile payment system designed by the Banco Central del Ecuador, can immensely help research. This program was introduced in 2014, with the aim of increasing financial inclusion and lower the need for holding and distributing big quantities of USD notes, but it was instead met by continuous criticism. One of the reasons it was unsuccessful was its failure to achieve popularity partially due to a lack of trust in the central bank. Trustworthiness and credibility of the issuer are further aspects to be taken into account concerning the introduction of a CBDC, as well as its legal implications. To sum up, despite the topics already studied, further research is still necessary, and the conclusions reached must be read in accordance with the evidence collected through the pilot projects.

- ↑ de Best, Raynor. “Cryptocurrency Users Worldwide 2020.” Statista, 14 Jan. 2022, www.statista.com/statistics/1202503/global-cryptocurrency-user-base/.

- ↑ Central Bank Digital Currency: Opportunities, Challenges and Design

- ↑ Bank of England (2020). Opportunities, challenges and design. [online] Available at: https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design.pdf.

- ↑ 4.0 4.1 4.2 4.3 Panetta, F. (2021). Cash still king in times of COVID-19. [online] Available at: https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210615~05b32c4e55.en.html.

- ↑ Atlantic Council. “CBDC Tracker.” Atlantic Council, www.atlanticcouncil.org/cbdctracker/.

- ↑ 6.0 6.1 Bank of Canada, et al. CBDC : Central Bank Digital Currencies : Foundational Principles and Core Features. Basle Bank For International Settlements, 2020.

- ↑ Allen, Sarah, et al. Design Choices for Central Bank Digital Currency Policy and Technical Considerations. 2020.

- ↑ European Central Bank. Report on a Digital Euro. 2020.

- ↑ Carstens, Agustí. The Future of Money and Payments* Bank for International Settlements. Apr. 2019.

- ↑ 10.0 10.1 Bank for International Settlements. Committee on Payments and Market Infrastructures Markets Committee Central Bank Digital Currencies. 2018.

- ↑ Deloitte. Central Bank Digital Currencies: Building Block of the Future of Value Transfer.

- ↑ Popper, Nathaniel. “Lost Passwords Lock Millionaires out of Their Bitcoin Fortunes.” The New York Times, 12 Jan. 2021, www.nytimes.com/2021/01/12/technology/bitcoin-passwords-wallets-fortunes.html.

- ↑ Bank for International Settlements. III. CBDCs: An Opportunity for the Monetary System. 2021

- ↑ Bank of Thailand. The Way Forward for Retail Central Bank Digital Currency in Thailand. 2021.

- ↑ Hong Kong Monetary Authority. “Hong Kong Monetary Authority - Central Bank Digital Currency (CBDC).” Hong Kong Monetary Authority, www.hkma.gov.hk/eng/key-functions/international-financial-centre/fintech/research-and-applications/central-bank-digital-currency/.

- ↑ Bank of International Settlements, et al. MBridge Building a Multi CBDC Platform for International Payments Participating Authorities.

- ↑ Agur, Itai, et al. “How Could Central Bank Digital Currencies Be Designed?, SUERF Policy Notes .:. SUERF - the European Money and Finance Forum.” SUERF.ORG, Feb. 2020, www.suerf.org/policynotes/9763/how-could-central-bank-digital-currencies-be-designed.

- ↑ 18.0 18.1 Nabilou, Hossein. “Testing the Waters of the Rubicon: The European Central Bank and Central Bank Digital Currencies.” Journal of Banking Regulation, vol. 21, 20 Aug. 2019, 10.1057/s41261-019-00112-1.

- ↑ Piazzesi, Monika, et al. Credit Lines, Bank Deposits or CBDC? Competition & Efficiency in Modern Payment Systems *. 2022.

- ↑ Schilling, Linda, et al. “Central Bank Digital Currency: When Price and Bank Stability Collide.” SSRN Electronic Journal, 2020, 10.2139/ssrn.3753147.

- ↑ Dyson, Ben, and Graham Hodgson. Why Central Banks Should Start Issuing Electronic Money DIGITAL CASH. 2016.

- ↑ Panetta, Policy Panel on Central Bank Digital Currencies. Annual Congress of the European Economic Association.

- ↑ European Central Bank. “What Is Seigniorage?” European Central Bank, 18 Nov. 2021, www.ecb.europa.eu/ecb/educational/explainers/tell-me/html/seigniorage.en.html.

- ↑ Engert, Walter, and Ben S. C. Fung. Central Bank Digital Currency: Motivations and Implications, Bank of Canada Staff Discussion Paper, No. 2017-16, Bank of Canada, Ottawa,. 2017.

- ↑ 25.0 25.1 25.2 25.3 25.4 25.5 25.6 25.7 Brunnermeier, Markus, et al. NBER Working Paper Series the Digitalization of Money. 2019.

- ↑ White, Lawrence H. “The World’s First Central Bank Electronic Money Has Come – and Gone: Ecuador, 2014-2018.” Cato Institute, 2 Apr. 2018, www.cato.org/blog/worlds-first-central-bank-electronic-money-has-come-gone-ecuador-2014-2018.

- ↑ Arauz, Andrés, et al. “Dinero Electrónico: The Rise and Fall of Ecuador’s Central Bank Digital Currency.” Latin American Journal of Central Banking, vol. 2, no. 2, June 2021, p. 100030, 10.1016/j.latcb.2021.100030.